Let's build a life together

At Dot MFB, we believe banking should do more than just move money. It should be fast, simple, and genuinely rewarding, whether you're handling your personal finances or growing a business from the ground up.

2021

Founding year

650k+

Customers

₦8.6B+

Loans Disbursed

₦2.3T

GTV processed

To be the preferred partner, leveraging technology and people to drive financial access to the underserved in Africa.

To innovate around our customers day to day challenges in order to deliver world class financial services.

Made for people & businesses

Since launching in 2021, we've been on a mission to build a financial experience that doesn't just meet expectations, but redefines them. Because we know that money should feel like freedom, not friction.

Powering Everyday Possibilities

We've built a bank that works the way you live and grow, from Dot Personal Banking for everyday needs to Dot Business Banking for entrepreneurs and companies shaping the future.

With Dot Points, every personal transaction becomes a small reward. Imagine finding money in your pocket while doing laundry or stumbling on hidden cash while cleaning- that’s the feeling we bring to banking. Every time you spend, you earn points that can be converted into real cash when you need it most. It’s like a little win, every single time.

Backing bold ideas

For businesses, we go beyond transactions. We provide fully functional Business Bank Accounts in your company's name, making it easier to manage payments, get paid faster, and keep your finances in check. And because we know that cash flow is everything, we offer tailored credit solutions and overdraft services to help you seize opportunities, cover unexpected costs, and keep operations running smoothly.

Speed and security are non-negotiables. Whether you're sending, receiving, or cashing out, personally or professionally, your money moves instantly and safely. No delays. No roadblocks. Just banking that works.

Here for the journey ahead

From personal savings to payroll, from impulse spending to expansion plans, we've built a bank that adapts to your journey, not the other way around. Because whether you're chasing your next milestone or just need to send money fast, we're here to make sure banking never gets in your way.

And we're not stopping. Every single day, we challenge ourselves to build better, to make banking smarter, safer, more human, and more rewarding. Because at Dot, we're not just a bank. We're your partner in progress, whether you're buying lunch or building an empire.

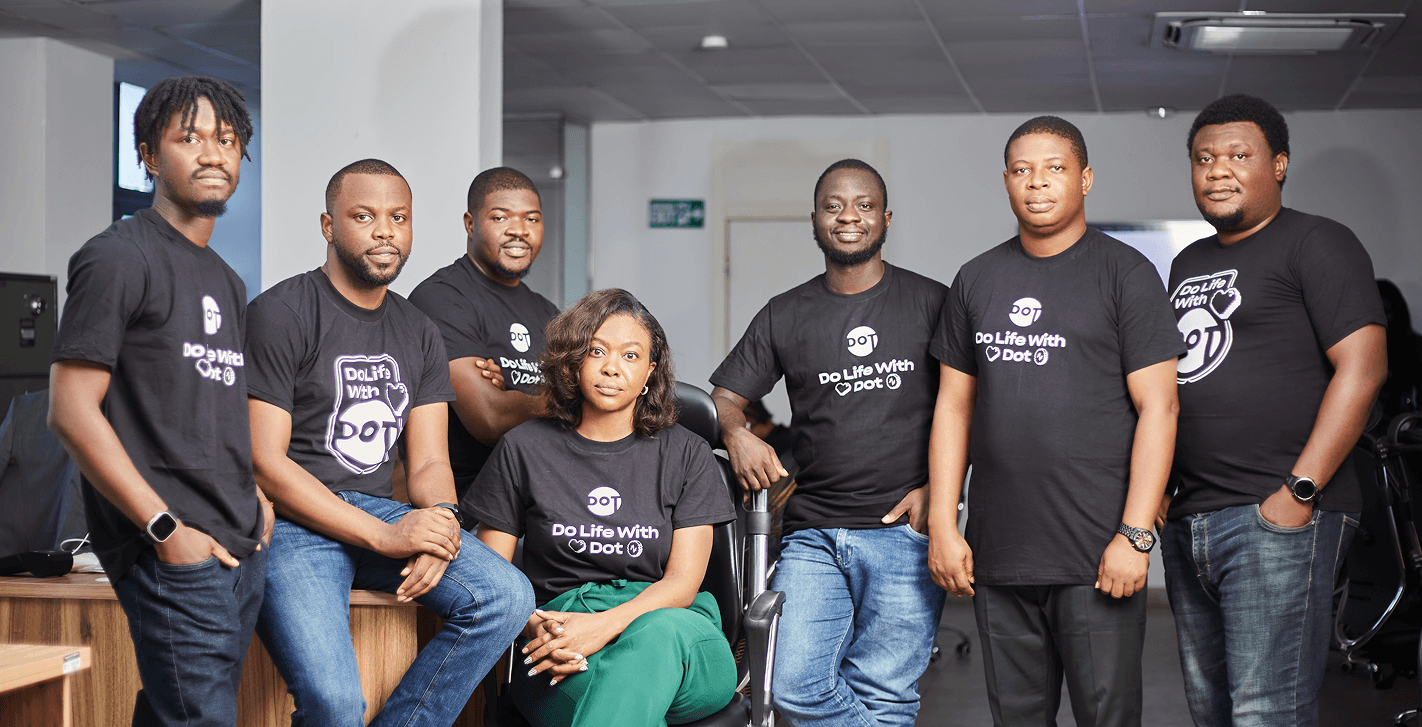

Become a Connector

We're working to find new and better ways to help people succeed, and we're always on the lookout for people like you to help them build a life beyond their next alert.

Join us at Dot